are st jude raffle tickets tax deductible

Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization. Meaning that those who are married and filing jointly can only get a 300.

St Jude Dream Home Giveaway Faq Everything You Need To Know Fox 8 Cleveland Wjw

We will also notify each winner in writing by sending a Winner Notification Agreement WNA by secure electronic communication or certified US.

. 455 Hoes Lane Piscataway NJ 08854 Phone. The irs requires that taxes on prizes valued greater than 5000 must be paid. The IRS has adopted the position that the 100 ticket price is not.

The IRS has determined that purchasing the chance to win a prize has value that is. Mail return receipt requested to the email. Organizations registered with the Legalized Games of Chance Control Commission use this form as a guide to ensure that all of the required information is printed on the ticket sold to.

Jude dream homes benefits st. Fails to withhold correctly it is liable for the tax. Generally interest expense on a debt is allocated in the same manner as the debt to which such interest expense relates is allocated.

Yerba Buena Center for the Arts interpretation and application of the rules and regulations shall be. The IRS considers a raffle ticket to be a. Youre signing up for a chance to win in a raffle.

LCVS 151 Dale Street Liverpool L2 2AH You will. For 2020 the charitable limit was. The IRS does not consider raffle tickets to be a tax-deductible contribution.

Jude Dream Home tickets arent tax-deductible. Send the LCVS form and cheque to. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. This is because the purchase of raffle. A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the Australian Taxation Office as a Deductible Gift Recipient organisation.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Interest Tracing Rules Under Temp. On October 31 2004 the drawing was held and Lou.

What is the limit on charitable deductions for 2020. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organizationThe IRS considers a raffle ticket to be a contribution. Raffle tickets are not tax deductible.

Write your cheque LCVS The School of St Jude Download our LCVS form and send with cheque. 300 per tax unit.

Why Do Grocery Stores Ask For Donations Tax Breaks

St Jude Dream Home Giveaway Tickets Sold Out

Dream Home Faq St Jude Children S Research Hospital

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Give The Gift Of Education Help St Jude Families Stjudeschool

/cloudfront-us-east-1.images.arcpublishing.com/gray/K5NDK5SWE5MH7NRELMZIM7TBZI.jpg)

St Jude Dream Home Giveaway Tickets Sold Out

2022 St Jude Dream Home In Sylvania Ohio Wtol Com

St Jude Dream Home Ticket Sell A Thon

Are Nonprofit Raffle Ticket Donations Tax Deductible

A 550 000 Home Raffle Ends With An Unfortunate Fortune Ktvb Com

Faq 2022 Fall San Francisco Bay Dream House Raffle To Benefit Yerba Buena Center For The Arts

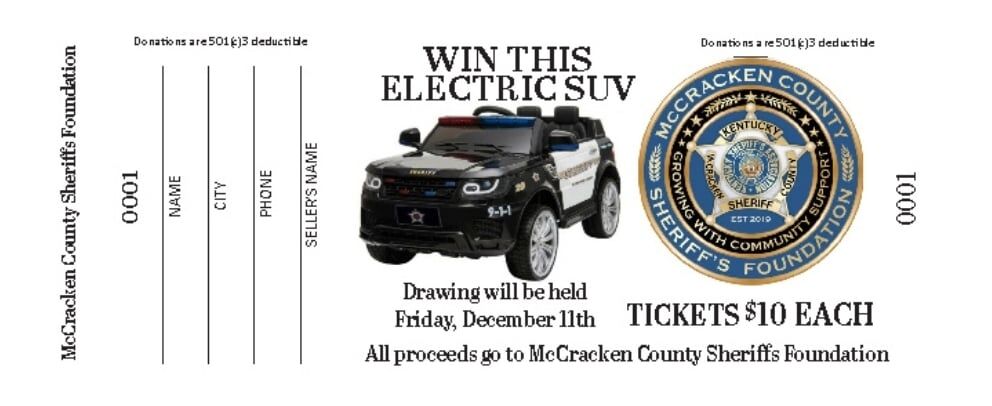

Raffle Tickets Available For Battery Powered Mccracken County Sheriff S Office Suv Span Class Tnt Section Tag No Link News Span Wpsd Local 6

S A Solutions Charity Work And Events

The Beacon The Beacon October 06 2022 Page 5

Win A Home Car And Help Children With Cancer Kfor Com Oklahoma City